Our Impact

Impact Stories

Helping consumers in debt distress

Desi was left with USD 25K credit card debt after her husband disappeared. Debt collectors harassed her and even visited her daughter’s workplace, resulting in her losing her job. Amalan stopped the harassment from debt collectors, helped Desi settle all her loans at a 55% discount and start to rebuild her wealth. Now Desi and her family are living in peace and are more proactive about financial planing

Empowering individuals in financial crises

Fajar lost his job and accumulated USD 18,000 of debt after he tried starting his own business. After signing up with Amalan, he was able to start paying off his loans using a long-term payment plan with affordable instalments and reduced interest

Our Impact Philosophy

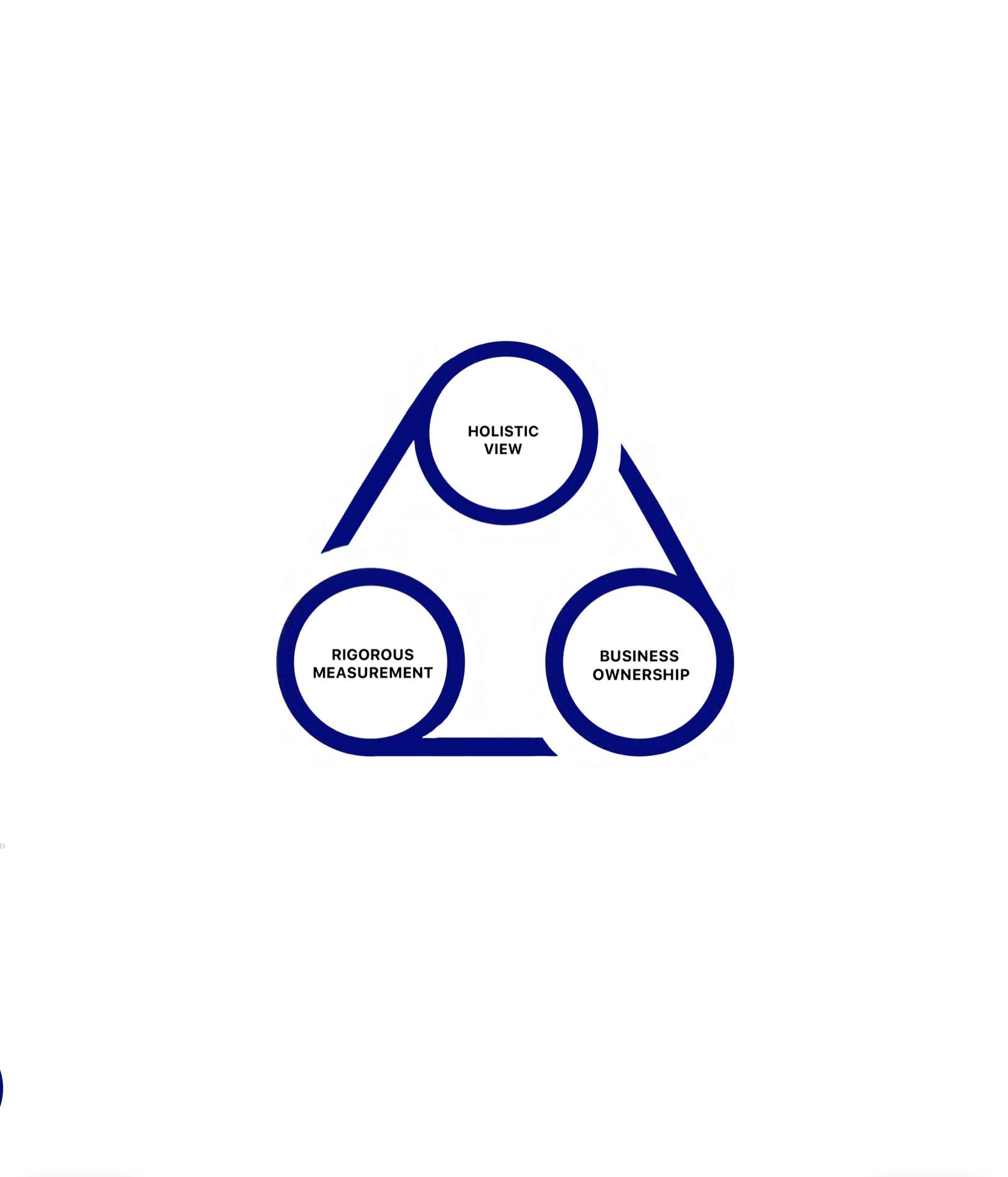

Holistic View

We aim to give those who are financially excluded greater access to better products and protection against climate perils. We give incentives for responsible and sustainable behaviours to promote climate adaptation. We aim to build more robust financial and economic systems.

Business Ownership

Business ownership of the impact metrics sets our impact philosophy apart from other frameworks. We want our portfolio companies to see lasting value in impact creation, and our approach is tailored to achieve this goal.

Rigorous Framework

Our Fund has a bespoke framework for financial services. We use quantifiable and transparent metrics which we track across time. Our goals align with UN SDG sub-goals, following global standards such as OPIM, GIIN and IRIS+.

Financial Inclusion

Through our investments, we aim to empower underserved populations and promote economic resilience by facilitating access to banking, insurance and other financial products and services.

Climate Adaptation

Aligned with the overarching objectives of the EU Taxonomy, our investments bolster climate adaptation efforts by empowering marginalized communities. We reinforce environmental resilience by increasing access to financial protection from climate perils and promote community readiness through risk advisory services.

Our Impact Framework

We have developed our proprietary Triple P ASPIRE framework to systematically measure and monitor the holistic impacts of financial inclusion and climate adaptation. We divide our impact objectives into four dimensions and use metrics that allow comparison across companies.

Sustainable Development Goals

Triple P aligns its impact objectives with the United Nations Sustainable Development Goals (UN SDGs). UN studies have shown that inclusive financial services drive progress on no less than eight UN SDGs. Of these eight, we have identified six key SDGs and specific sub-goals within each of these that we aim to address through our and our portfolio companies’ efforts.

-

Target 1.4 By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property, inheritance, natural resources, appropriate new technology and financial services, including microfinance.

Target 1.5 By 2030, build the resilience of the poor and those in vulnerable situations and reduce their exposure and vulnerability to climate-related extreme events and other economic, social and environmental shocks and disasters.

-

Target 3.8 Achieve universal health coverage, including financial risk protection, access to quality essential health-care services and access to safe, effective, quality and affordable essential medicines and vaccines for all.

-

Target 5.5 Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision making in political, economic and public life.

Target 5.A Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws.

-

Target 8.5 By 2030, achieve full and productive employment and decent work for all women and men, including for young people and persons with disabilities, and equal pay for work of equal value.

Target 8.10 Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

-

Target 9.3 Increase the access of small-scale industrial and other enterprises, in particular in developing countries, to financial services, including affordable credit, and their integration into value chains and markets.

-

Target 13.1 Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries.

Target 13.2 Integrate climate change measures into national policies, strategies and planning.