Potential of Financial Services in Southeast Asia

Why Southeast Asia

Investing in Southeast Asia’s financial services market offers a compelling opportunity due to the region’s strong economic growth and substantial insurance gaps.

Southeast Asia’s Growth Opportunity

Southeast Asia is predicted to remain one of the most attractive global growth markets for the foreseeable future. Half of the world’s spending growth will come from Asia in the next decade. Production costs are low and trade within the region is growing rapidly. ASEAN’s rising economies are becoming more attractive to foreign investors than in the past.

At Triple P, we believe that Southeast Asia offers a particularly attractive opportunity for investors to pursue mid-market opportunities.

Emerging Consumers

Many people in Southeast Asia are only just entering the formal economic system. These emerging consumers, who number almost 450 million in Triple P’s target market, offer an attractive and relatively untapped market segment.

Emerging consumers have a significant financial capacity, contributing to Southeast Asia’s $300 billion in disposable income.

-

Financial Services is a Levered Growth and Impact Play

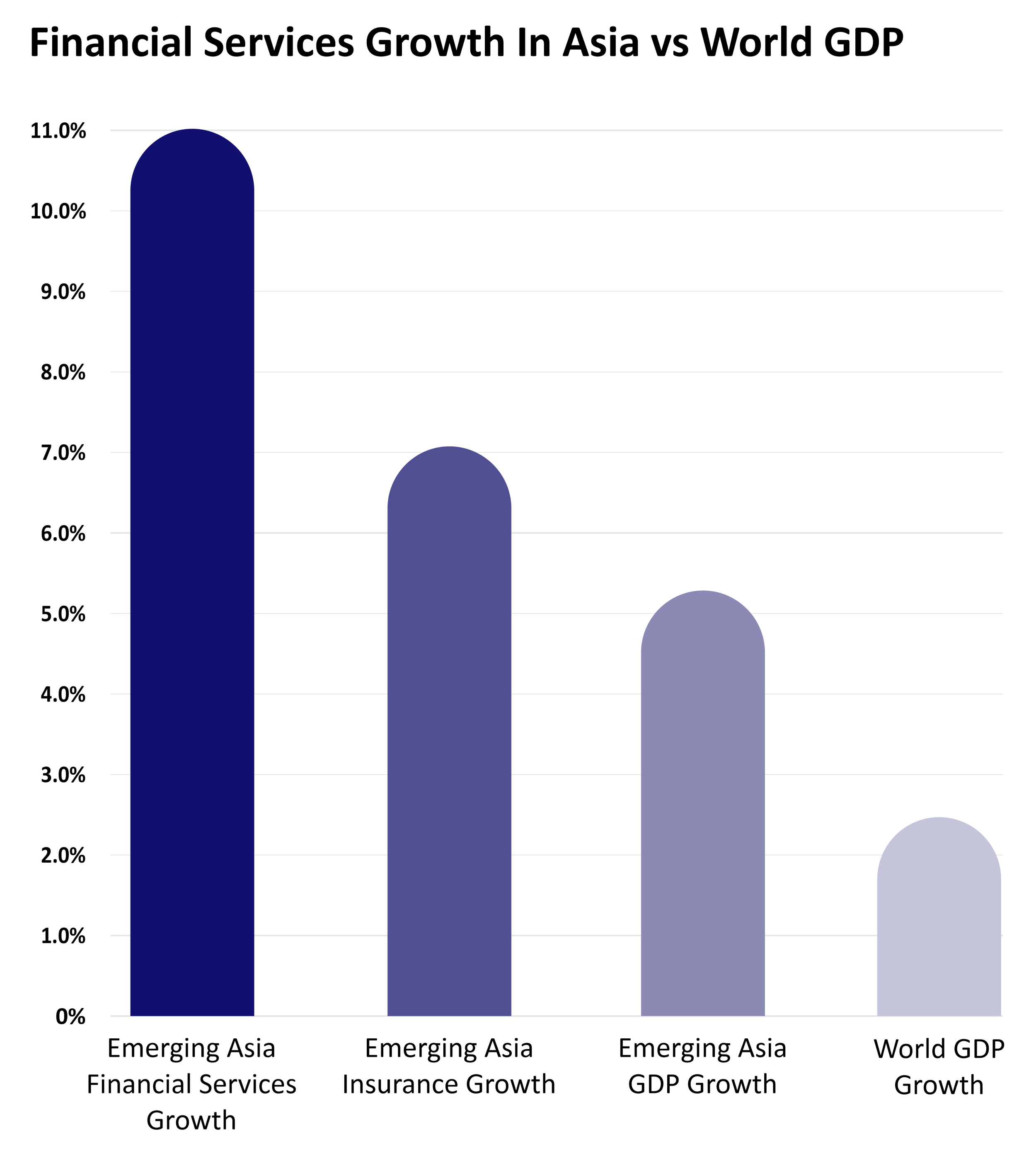

Southeast Asis offers significant investment potential in financial services, with growth rates over twice that of GDP (12.8% vs. 5.5%) in recent years. The region’s low financial services penetration - especially among underserved SMEs and consumers - presents a huge opportunity.

With merging digital financial products and innovative service delivery models, financial services can drive poverty reduction, support economic growth, and meet the needs of a rapidly changing consumer base. This dynamic environment positions investors to benefit from both high returns and impactful social progress.

-

Investment Opportunities

Triple P’s investment focus on the emerging consumer market. The specialist skills required to evaluate financial services investments in addition to the fewer number of mid-market investors further reduce the potential for deal competition.

Mid-market companies that are looking for both capital and know-how to fuel growth will likely see Triple P as a preferred partner.

Insurtech & Digitalization

The insurance sector in Southeast Asia is being transformed by insurtech models and rapid digitalization, affecting the entire value chain. Innovations like improved data use for underwriting, faster claim processing, and new distribution methods, such as embedded insurance, are driving this change.

“Tech-enabled distributors” that adopt these tools effectively are expected to outperform, offering significant opportunities for mid-market and smaller players.